Challenge

This bank and insurance multinational customer wanted a solution a KYC (Know Your Customer) process which required the validation of ID images and data captured from various sources - smartphones, personal scanning devices, email attachments, third party business process outsourcing (BPO), etc. - and received in various formats like .pdf, .tiff, .jpg and others. This periodic verification process of customer data authenticity requires compliance with banking sector rules and anti-money laundering, anti-bribery and anti-corruption due diligence regulations. The customer’s objective was to streamline its onboarding and KYC processes with efficient document reading and data verification, easily integrated into the value chain.

Solution

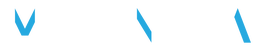

The docBrain features / capabilities read multiple document formats of varying quality from multiple angles. The customer business process was changed and automated to include a docBrain document qualification intervention. The docBrain neural network reads, extracts and qualifies the data (find multiple ID, verify the recto/verso, avoid old format, etc.) to be forwarded back to the customer for validation in their business systems. The benefits to the customer are a faster and improved KYC process as well as time, cost and manpower savings since no data entry or re-entry is necessary.

The customer intends to further use the docBrain platform to conceive new tailor-made solutions swiftly for other business processes to be improved.